India’s Green Game Changer: How Solar Keeps Coal in Check in 2025

India, a nation known for its rapidly expanding economy and burgeoning energy demand, faces a monumental challenge: how to power its growth sustainably. For decades, coal has been the undisputed king of India’s energy landscape. However, early data from 2025 reveals a significant shift: a surging solar boom is now playing a pivotal role in keeping coal use in check.

This isn’t just a minor blip; it’s a testament to India’s aggressive renewable energy push and a potential harbinger of a cleaner energy future. While coal remains dominant, the unprecedented growth of solar power is beginning to temper its relentless expansion, a crucial step in India’s complex energy transition.

This article delves into the latest trends from early 2025, exploring the remarkable growth of solar generation, the mechanisms by which it’s influencing coal consumption, and what this means for India’s journey towards a more sustainable and secure energy mix.

- 1. The Solar Surge: Unprecedented Growth in Early 2025

- 2. The Direct Impact: How Solar Curbs Coal’s Dominance

- 3. Policy & Economic Tailwinds Fueling the Green Shift

- 4. The Path Ahead: Challenges and the Long-Term Outlook

- Frequently Asked Questions (FAQs) About India’s Energy Transition

- Q1: What is the significance of “India’s solar boom keeping coal use in check in 2025”?

- Q2: How much has India’s solar power generation increased in early 2025?

- Q3: Is India reducing its overall coal consumption?

- Q4: What role do government policies play in India’s solar growth?

- Q5: What are the main challenges for India’s energy transition away from coal?

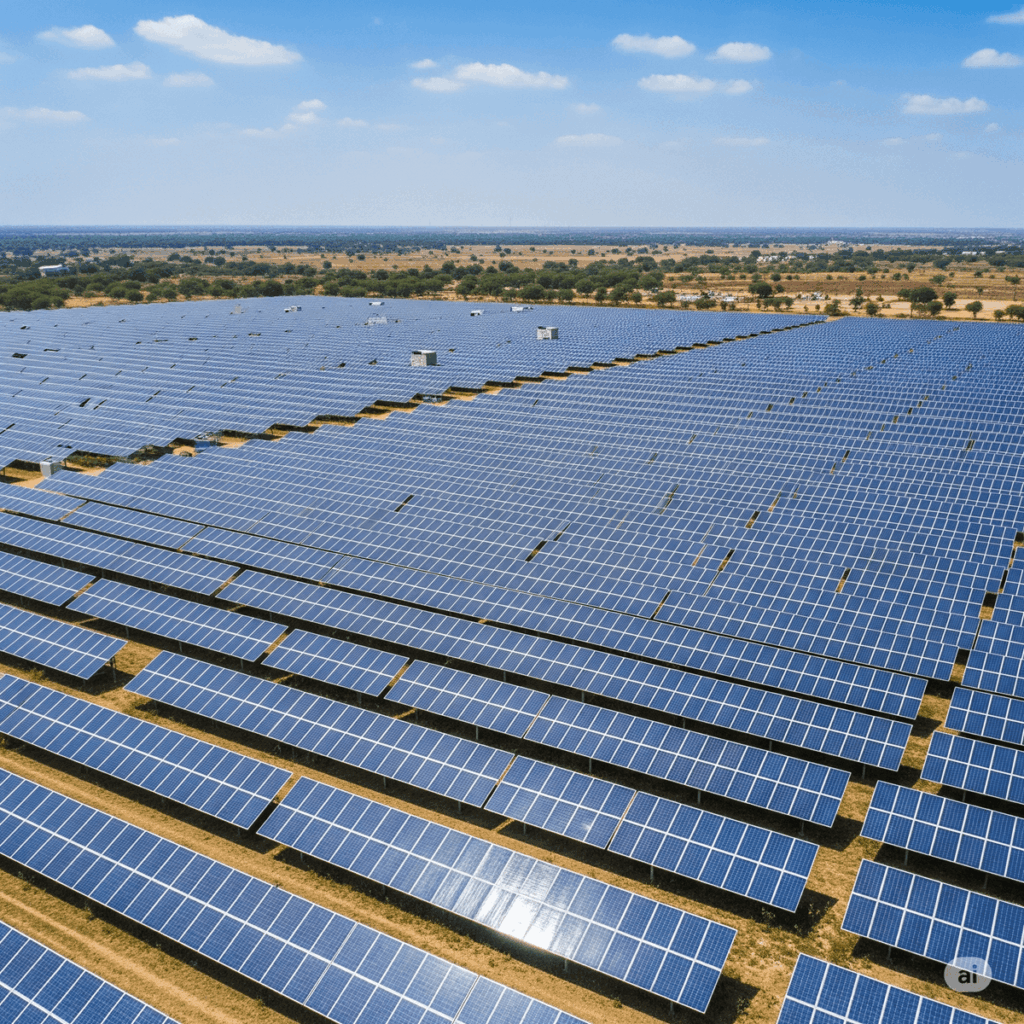

1. The Solar Surge: Unprecedented Growth in Early 2025

The first few months of 2025 have underscored India’s commitment to solar energy, showcasing truly remarkable growth figures:

- Record Solar Generation: From January to April 2025, India witnessed a record 32.4% jump in solar generation compared to the same period last year, reaching an unprecedented 57.8 terawatt-hours (TWh). This surge alone is a powerful indicator of solar’s rising influence.

- Growing Share in the Mix: This heightened output lifted solar power’s share of India’s total electricity generation mix to a record 10% during March and April 2025, a significant leap from an average of 7% in 2024.

- Overall Clean Power Expansion: The wider clean power generation sector in India also experienced a robust 23% increase during January-April 2025, contributing to a record 23.3% share of India’s total electricity production. This broader renewable growth, combined with anticipated above-average monsoon rains boosting hydropower, creates a formidable counterforce to coal.

- Rapid Capacity Additions: The foundation for this generation boom is aggressive capacity deployment. In the fiscal year 2024-25 (ending March 2025), India added an impressive 29.52 GW of renewable energy capacity, with solar leading the charge by contributing 24 GW. Specifically, in Q1 2025 (January-March), 6.7 GW of new solar capacity alone came online, pushing India’s cumulative solar capacity to over 107.95 GW by April 2025.

These figures highlight that India’s solar boom is not just a promise but a rapidly unfolding reality, directly impacting the country’s energy supply and, critically, its reliance on fossil fuels.

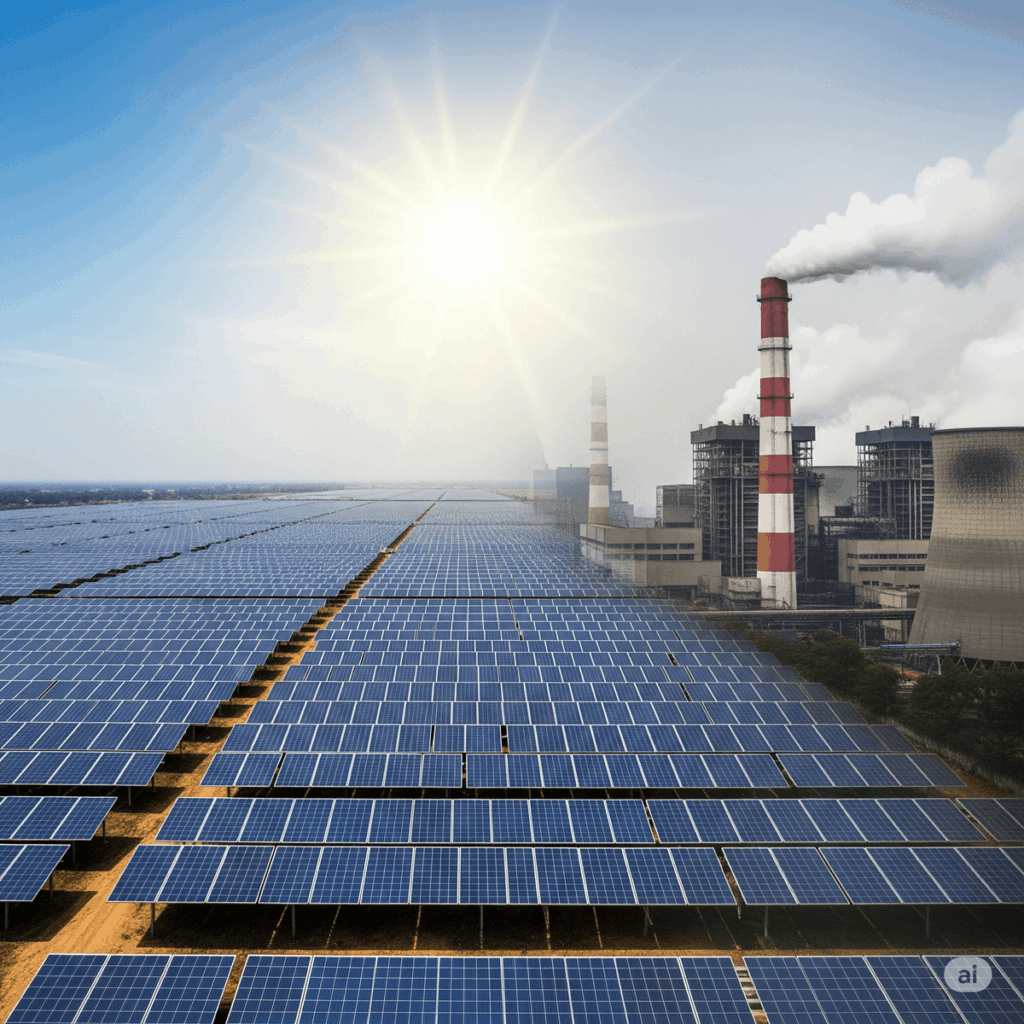

2. The Direct Impact: How Solar Curbs Coal’s Dominance

The crucial narrative in early 2025 is not just solar’s growth but its direct influence on coal consumption. Despite a consistently rising overall electricity demand, solar power’s surge has achieved a significant feat:

- Flattening Coal Generation: During the January-April 2025 period, utilities were able to keep coal-fired generation flat compared to the previous year. This is a rare occurrence given India’s typical year-on-year increases in power demand, where coal usually expands to meet the growing need.

- Trimming Fossil Fuel Output: Overall, fossil fuel-fired power plant generation was trimmed by approximately 0.5% in January-April 2025 compared to the same period in 2024. While seemingly modest, this reduction is notable, as India’s energy demand growth typically leads to continuous expansion in fossil fuel deployment.

- Displacing Natural Gas: Solar’s rising output also directly led to a 27% cut in natural gas-fired power production, which is often a more expensive and less baseload-reliable fossil fuel alternative than coal.

- Meeting Peak Demand: Solar power generation peaks during the daytime, aligning perfectly with India’s highest power demand periods. By injecting substantial amounts of clean electricity into the grid during these crucial hours, solar reduces the immediate need to fire up or heavily rely on coal-based power plants, essentially deferring or avoiding additional coal consumption.

- Reduced Coal Imports: Reflecting a broader strategic push, India’s coal imports also saw a decline of 7.9% in the fiscal year 2024-25, resulting in significant foreign exchange savings. This is partly due to increased domestic coal production but also indicates a reduced overall dependence on imported thermal coal for power generation.

This dynamic interplay demonstrates that solar isn’t just adding to India’s energy supply; it’s actively influencing the dispatch order of power plants, pushing coal-fired generation further down the priority list during peak solar hours.

3. Policy & Economic Tailwinds Fueling the Green Shift

India’s solar boom isn’t accidental; it’s the result of strong governmental intent and a confluence of favorable economic factors:

- Ambitious National Targets: India has set a formidable target of achieving 500 GW of non-fossil fuel-based energy capacity by 2030, with solar specifically aiming for 280 GW. This clear policy directive provides certainty and encourages massive investment.

- Supportive Schemes: Initiatives like the PM Surya Ghar: Muft Bijli Yojana aim to popularize rooftop solar across households, while the Production Linked Incentive (PLI) scheme for solar PV modules is significantly boosting domestic manufacturing capacity. This supports the “Make in India” initiative and reduces reliance on imported solar components.

- Competitive Tariffs: The declining cost of solar power makes it increasingly competitive with traditional fossil fuels. This economic advantage naturally drives its adoption by utilities and private developers.

- Private Sector Investment: The clear policy roadmap and attractive economics have led to a surge in private sector investment in India’s renewable energy sector. The first quarter of 2025 alone saw total investments reach US$9.84 billion, a remarkable 7.7-fold increase compared to Q1 2024, representing the highest quarterly investment in the last three years.

- Grid Modernization Efforts: To effectively integrate the intermittent nature of solar power, India is actively investing in grid modernization and the development of energy storage solutions, ensuring stability and reliability of the power supply as renewables penetrate deeper into the mix.

These combined efforts create a robust ecosystem that not only fosters solar growth but also helps manage the national energy demand without an unbridled increase in coal consumption.

4. The Path Ahead: Challenges and the Long-Term Outlook

While the early 2025 data paints an optimistic picture, it’s crucial to acknowledge the ongoing complexities of India’s energy transition:

- Persistent Coal Reliance: Despite solar’s significant growth, coal remains the primary source, supplying around 75% of India’s electricity needs. In March 2025, coal-based generation even saw an 8% year-on-year rise to meet overall demand, indicating that while solar is checking growth in coal generation share, it isn’t yet displacing overall coal use on a massive scale.

- Soaring Demand: India’s electricity demand continues to grow at a robust pace, with a forecast of 6.3% annual growth from 2025 to 2027. This rapid expansion means that even with massive renewable additions, simply keeping coal use in check is a significant achievement, not necessarily a decline in absolute terms yet.

- Baseload Power and Storage: Coal-fired plants provide crucial baseload power, which renewables currently cannot fully replicate without substantial, cost-effective energy storage solutions. While large-scale battery storage is in development, its widespread deployment is still some years away.

- Grid Integration and Stability: Integrating vast amounts of intermittent renewable energy requires significant upgrades to grid infrastructure and sophisticated management systems to ensure stability.

Despite these challenges, the trajectory is clear. The early 2025 trends confirm that India’s solar boom is indeed a green game changer. It’s effectively putting a leash on coal’s growth, especially in terms of its share in the energy mix. As solar capacity continues its aggressive expansion and complementary technologies like battery storage mature, India’s aspiration for a cleaner, more sustainable energy future moves steadily closer to reality.

The ongoing dance between solar and coal in India will be one of the most important stories in global energy transition for decades to come, and 2025 is proving to be a pivotal year in this unfolding narrative.

Frequently Asked Questions (FAQs) About India’s Energy Transition

Q1: What is the significance of “India’s solar boom keeping coal use in check in 2025”?

A: It means that despite a rapidly growing electricity demand, the significant increase in solar power generation in early 2025 has prevented coal-fired power generation from increasing at its usual pace. Instead, coal generation has remained relatively flat, and overall fossil fuel generation has even seen a slight decline compared to the previous year.

Q2: How much has India’s solar power generation increased in early 2025?

A: From January to April 2025, India’s solar generation jumped by a record 32.4% year-on-year, contributing 57.8 TWh of electricity. Solar’s share in the total electricity mix reached 10% in March-April 2025.

Q3: Is India reducing its overall coal consumption?

A: While coal-fired generation has been kept flat in early 2025 and fossil fuel generation saw a modest decline, the overall consumption of coal for power generation is still very high, and coal production in India continues to increase to meet overall demand. “In check” implies controlling growth rather than outright reduction, though continued solar growth combined with strong hydropower could lead to a rare year-over-year reduction in total coal use in 2025.

Q4: What role do government policies play in India’s solar growth?

A: Government policies like the target of 500 GW of non-fossil fuel capacity by 2030, the PM Surya Ghar scheme for rooftop solar, and Production Linked Incentive (PLI) schemes for solar manufacturing are crucial drivers. These policies provide clear targets, incentives, and support for the expansion of solar power.

Q5: What are the main challenges for India’s energy transition away from coal?

A: Key challenges include managing India’s rapidly growing electricity demand, ensuring grid stability with increasing intermittent renewable sources, developing sufficient energy storage solutions, and addressing the socio-economic implications of reducing reliance on the coal sector.